Golden rules of accounting

Golden Rules of Accounting

Financial accounting is more than just book-keeping. In accounting, every transaction has a dual entry – debit and credit. It is important to identify which account has to be credited and which one is debited. This is the dual entry system of accounting. Financial accounting revolves around three rules, known as the golden rules of accounting.

These golden rules ensure the systematic recording of financial transactions. The golden rules simplify the complex book-keeping rules into a set of principles that are easily understood, studied, and applied.

Types of accounts

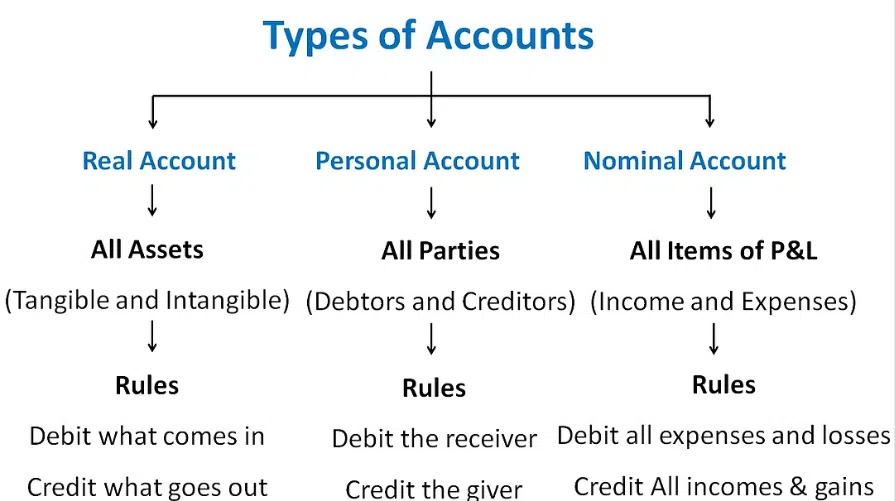

The golden rules of accounting help in documenting financial transactions in ledgers. These golden rules are based on the type of account. Each transaction will have a debit and credit entry and belong to one of the following three types of accounts.

- Real Account

- Personal Account

- Nominal Account

Real Account

A real account is a general ledger account that reflects all the transactions relating to assets and liabilities. It comprises tangible and intangible assets. Tangible assets such as furniture, land, building, machinery, etc. On the other hand, intangible assets such as goodwill, copyright, patents, etc.

Real accounts are carried forward to the following year, therefore, are not closed at the end of the financial year. Furthermore, a real account appears in the balance sheet. A furniture account is a type of real account.

Personal Account

A personal account is a general ledger account relating to persons. It can be natural persons like individuals or artificial persons like companies, firms, associations, etc. When company A receives money or credit from another business or individual, company A becomes the receiver. And, the other business or individual who gives it becomes the giver, in the case of a personal account. A creditor account is a type of personal account.

Following are the subcategories of personal accounts:

- Artificial Personal Account: This type of account represents legal entities that are not considered human beings by law. Examples of artificial personal accounts are hospitals, banks, partnerships, government bodies, etc.

- Natural Personal Account: This represents human beings. For example, creditor, debtor, capital account, drawings account, etc.

- Representative Personal Account: This account represents accounts of both natural and artificial entities. The transactions in this account either belong to the previous year or the coming year. For example, salary is drawn in advance, or salary due from the previous years, etc.

Nominal Account

A nominal account is a general ledger account relating to all business income, expenses, profit, and losses. It accounts for all transactions pertaining to one fiscal year. As a result, the balances are reset to zero and can start afresh. An interest account is a type of nominal account.

Rules

Real account: Debit What Comes In, Credit What Goes Out.

This rule applies to real accounts. Furniture, land, buildings, machinery, etc., are included in real accounts. By default, they have a debit balance. As a result, debiting what is coming in adds to the existing account balance. Similarly, when a tangible asset leaves the firm, crediting what goes out reduces the account balance.

For example, Company X pays rent worth INR 75,000 on June 1st 2022. This transaction will be recorded as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/6/2022 | Rent Account | Rs 75,000 | – |

| 1/6/2022 | Cash Account | – | Rs 75,000 |

Personal account: Debit the Receiver, Credit the Giver.

This rule applies to personal accounts. When a real or artificial person donates something to the organization, it becomes an inflow, and the person must be credited in the books. Conversely, the receiver must be debited.

For example, Company X donated INR 1,50,000 in cash to an NGO on 2nd October 2022. This transaction will be recorded as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 2/10/2022 | NGO Account | Rs 1,50,000 | – |

| 2/10/2022 | Cash Account | – | Rs 1,50,000 |

Nominal account: Debit All Expenses and Losses, Credit all Incomes and Gains.

This rule applies to nominal accounts. A company’s capital is its liability. As a result, it has a credit balance. Crediting all the income and gains will increase the capital. On the other hand, capital reduces when expenses and losses are debited.

For example, Company X sells its machinery for INR 50,000 on 1st July 2022. This transaction will be recorded as follows:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1/7/2022 | Machinery Account | Rs 50,000 | – |

| 1/7/2022 | Cash Account | – | Rs 50,000 |

**Advantages of Golden Rules of Accounting **

The following are the advantages of the golden rules of accounting:

- Proper Maintenance of Books of Accounts: Following the golden rules of accounting will ensure uniform maintenance of company accounts and business records.

- Analysis: The company’s management can easily analyze its performance across the years with well-maintained records.

- Valuation: While performing a company’s valuation, these financial statements will help understand the business revenues and expenses.

- Budgeting: Properly maintaining the financial transactions and accounting practices will help in budgeting and also estimating future projections of the company.

- Taxation and Regulatory Affairs: Following the golden rules of accounting will help in avoiding any shortfalls in taxes and regulator matters. Lack of accounting discipline will attract penalties and other regulatory complications.

Conclusion

Golden rules of accounting lay the foundation for preparing financial accounts. The company must record every transaction. Each transaction is recorded as a journal entry and then as a ledger. You should ascertain the account each transaction belongs to and then do journal entries based on the three golden rules. Therefore, it is a must to know the golden rules of accounting for the purpose of bookkeeping